Vietnam’s wood exports reached $8.34 billion in the first half of the year. It was only up 2% over the same period, which was a very modest figure compared to strong export sectors like seafood and textiles.

As the 5th largest exporter of wood and forest products in the world, Vietnam’s wood industry has entered 2022 with an optimistic expectation that it can continue to maintain a high growth momentum (equivalent to 19.7% growth in 2021), thanks to the benefit of signed international trade agreements and the stable operation of businesses after the pandemic.

In contrast to the strong growth of other export sectors, such as seafood and textiles, however, the export value for the first half of the year was recorded at $8.34 billion (a 2% increase over the same period) – a rather disappointing figure.

The element that is anticipated to salvage this year’s growth will come from the third quarter of 2022, with a forecast that will rise sharply due to the low baseline resulting from social distancing in the third quarter of 2021.

So, what challenges are Vietnamese enterprises’ wood exports facing?

Growth momentum decreased following the cooling of the US housing market?

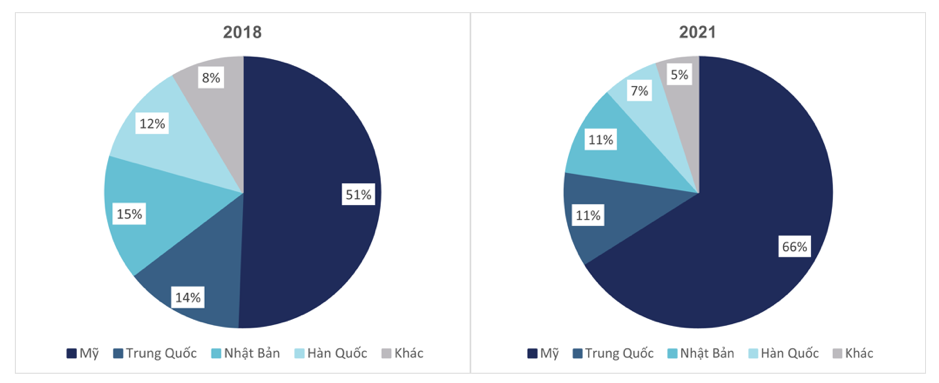

The proportion in the export structure by market increasing from 51% (2018) to 66% (2021) shows the fact that the output of export wood products of Vietnam is increasingly dependent on the US market.

In particular, the group of wood products that Vietnamese businesses focus on promoting consumption in this market is mainly home furnishings, such as living room furniture, dining room furniture; bedroom furniture, and wooden frame chairs… That’s why the boom of the housing market in the US in 2021 has brought many positive impacts, pulling Vietnam’s wood export growth to 19.7% year-on-year, despite the fact that the industry did not have a favorable 3rd quarter of 2021 because of regulations on social distancing.

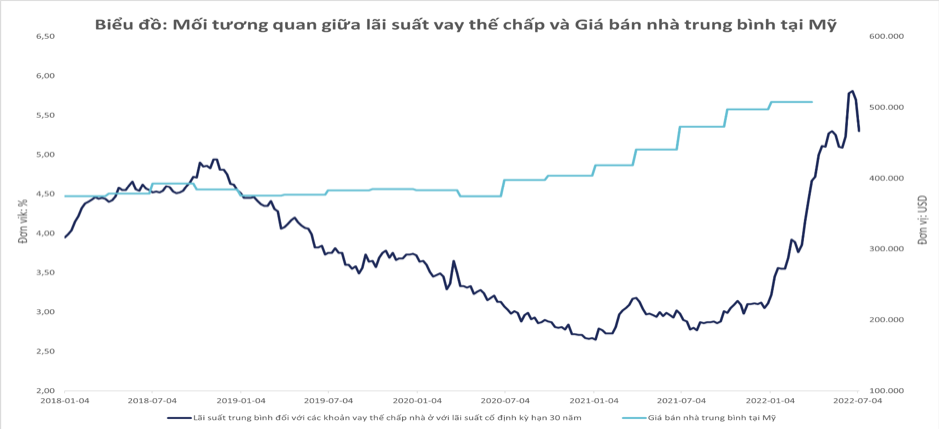

However, with mortgage interest rates starting to increase sharply from the beginning of 2022 and currently remaining above 5%, the previous positive trend of the US housing market is no longer maintained. The number of people wishing to buy a home is gradually decreasing, while the average home selling price continues to increase—reaching the milestone of $507,800 (+20% over the same period in 2021) is a barrier that makes the US housing market has cooled since the beginning of the year, followed by a decrease in the demand for wooden furniture.

This is the primary factor causing Vietnam’s wood exports to the US to become breathless and lose their previous growth momentum.

In addition, high inflation in the United States has a negative effect on the demand for imported wood products as discretionary spending is curtailed.

High logistics costs lead to the trend of shifting production areas

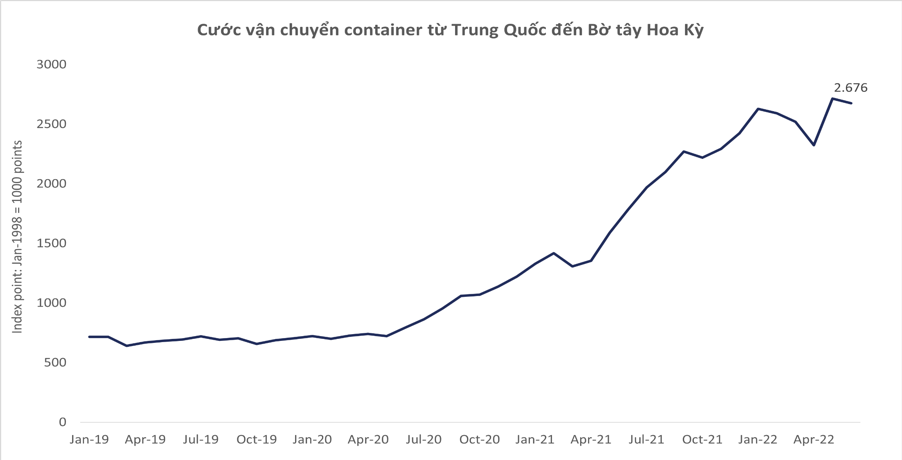

In comparison to the same period in 2021, container freight rates to the United States have remained high, ranging from 10,000 to 14,000 USD per container, which has nearly doubled the price of each order of wooden furniture from Vietnam.

Although almost all Vietnamese wood export companies sell at FOB prices, the decline in the competitiveness of Vietnamese wood products is invisible due to the high freight rates.

Specifically, customers in the US and EU markets are prioritizing the selection of nearby suppliers in certain South American and Eastern European nations, where production labor costs are high but are offset by geographical advantages and lower logistics costs compared to Vietnam. Thereby, it creates pressure to force domestic manufacturing enterprises to accept reduced selling prices in order to share freight risks. This situation is anticipated to persist so long as freight rates remain within the current price range.

Enterprises face challenges in their production activities due to the high cost of input materials.

The international wood material market has experienced a supply shortage as a result of the FSC’s ban on Russian wood exports. Consequently, EU wood suppliers are compelled to retain a portion of raw wood to compensate for the volume of timber imported from Russia, announcing an increase in export prices of raw wood to partners (+20 60% over the same period). As a result, Vietnam’s imports of timber from other markets also face numerous challenges.

To minimize the impact of this price increase, domestic producers have been compelled to seek alternative domestic wood sources.

However, the capacity of domestic wood supply remains quite limited. The proportion of planted forest wood used for furniture processing is still low, comprising only 30-40% of the total amount of harvested timber; the remaining 60-70% is primarily used for the production of wood chips and pellets. As a result, businesses can only replace certain product components with domestic wood.

However, the price of this material, specifically acacia wood, has increased by more than 20% during the same time frame (ranging from 1,050,000 VND to 1,320,000 VND).

The reason for this is that the price of woodchips has skyrocketed, resulting in the massive exploitation and acquisition of acacia for woodchip production. Difficulties in acquiring raw wood are preventing many companies from continuing to receive new orders and forcing some to suspend production.

Source: Vietnam Investment Newspaper